Focus on ... Newsletter

May 2020

May 22nd 2020

Paper sector is divided into two subareas:

- Graphic paper

- Packaging

Graphic paper is currently suffering due to digital technology increases and packaging, consumption of cardboard and packaging paper is quite good, driven both by e-commerce and the sustainability and recyclability of paper compared to other materials such as plastic.

A higher focus on environmental issue is reporting a good growth in the use and production of recycled paper with the need in defining new production methods. In 2018, paper was the most recycled product in Europe and accounted for 71.6% of paper consumption according to the Confederation of European Paper Industries (CEPI). This trend could also benefit from long term perspective being an alternative material in various fields such as packaging and construction. Paper sector actors are highly innovative and are constantly seeking new possible uses for their products, which will allow the sector to diversify and lessen its dependence on graphic paper (which is on the decline) and packaging paper (closely linked to economic conditions).

Paper sector is strongly depending on pulp prices, which after increasing in 2017 and 2018, fell in 2019 due to the economic slowdown in China. China alone imports 35% of the world’s wood pulp exports.

Movements in pulp prices will have very different effects on different sector participants depending on whether they are pulp or paper producers, as paper producers use pulp as an input.

2020 is forecasted as quite tough for the overall sector with the following paths:

- Graphic paper consumption is expected to continue to decline, following the trend observed in recent years.

- Consumption of cardboard and packaging paper, which is more procyclical, is expected to slow due to a general economic crisis and a decrease of the request coming from China

Strengths

- Sustainable and recyclable materila

- Strong demand from Asia

- Increasing use of packaging paper due to the rise of e-commerce

Weaknesses

- Demand for cardboard and packaging paper closely linked to the economic situation

- Graphic paper gradually being replaced by digital media owing to increasing use of digital tools

Digital and ecommerce are transforming industry

The use of graphic paper is on a downward trend as paper media are replaced by digital tools such as smartphones, readers and online newspapers. As a result of this declining demand, paper mills are switching their machines to the production of packaging paper, leading to a decline in graphic paper production capacity in favour of packaging paper. This trend is expected to continue in the coming years.

Packaging paper consumption is rising, driven by the development of e-commerce and the increasing use of paper as an alternative material to other packaging, such as plastic, which are considered more polluting. Consumption of cardboard and packaging paper increased by 11% between 2013 and 2018 in UNECE countries.

This trend, comprising a shift from graphic paper to digital and increased production of packaging paper, is common to all regions of the world.

Global wood pulp prices are falling, mainly because of the global economic slowdown and diminishing Chinese demand. Lower wood pulp prices will have different effects on different participants. They will benefit paper producers (which use pulp as an input) but will lower pulp producers’ margins. Lower wood pulp prices will have different effects on different participants. They will benefit paper producers (which use pulp as an input) but will lower pulp producers’ margins.

Source: COFACE

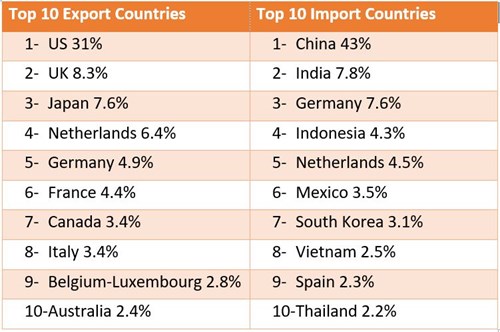

Recovered Paper is the 286th most traded product and the 715th most complex product according to the Product Complexity Index (PCI). Recovered Paper is also known as recycling, scrap.

Overall value is $10.7B.